Solutions to common payroll-related problems

Task Checklist

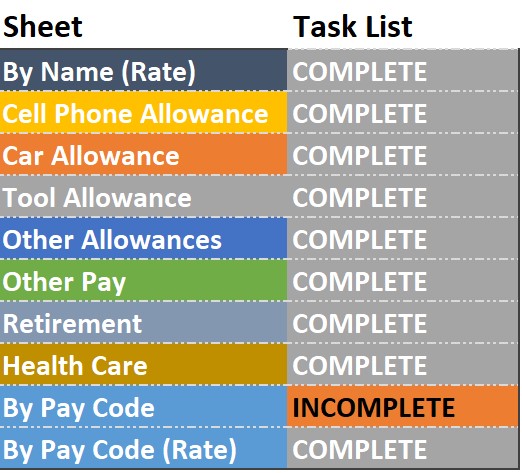

How do you create an organized and systematic approach to reviewing payroll?

How might you ensure your team gives equal treatment to vetting established allowances as they give to transmittal payments?

The Review Payroll task page is an organized list of tasks with a view to which have been completed, and which tasks require attention.

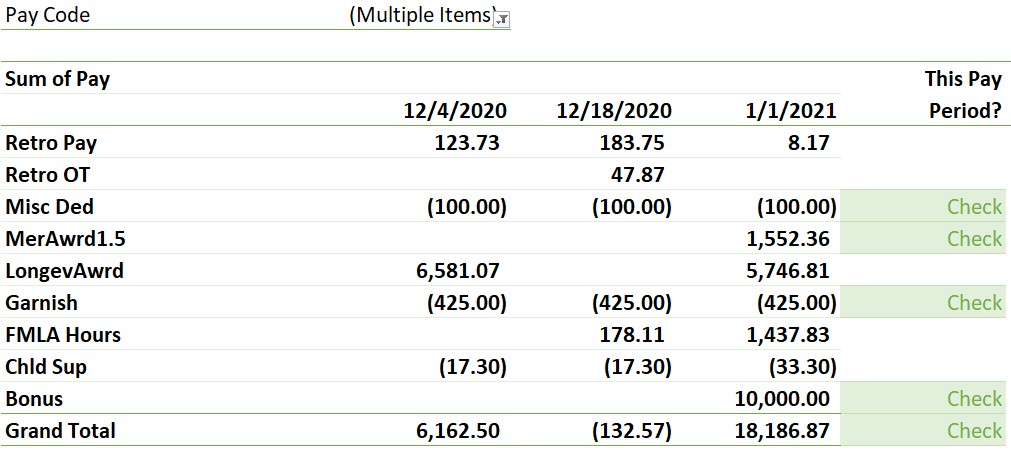

Pay Codes

What kinds of payroll issues seem like they never end?

Which pay codes are the problem? How might you catch the issues before live checks and/or ACH payments are made?

These are the types of questions that are addressed in the Pay Code portion of your Review Payroll tool.

Rate of Pay

How do you ensure every person is at their correct rate of pay?

Check subordinate pay within a department or across departments organized by name, employee number, or another configuration.

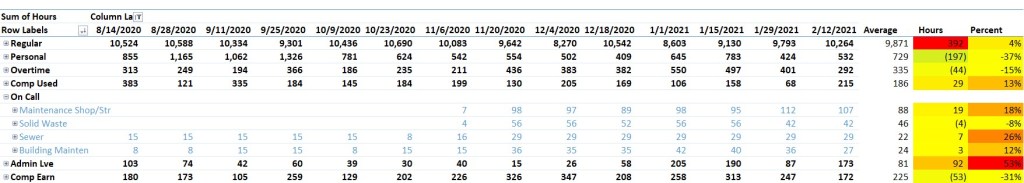

- What does this pay period look like compared to the one prior?

- What does it look like compared to 6 months? 12 months?

- Are there trends? Does this one stand out and contain anomalies?

- Why is one pay code trending over another?

- How do you spot fraud in payroll?

- How can you prevent fraud in payroll?

These and other high-altitude questions can be answered by aggregating data from prior pay periods and organizing them in a way that is meaningful for whoever the end user happens to be. Executive staff typically has an interest in these data, and we can create dashboards that allow them to ask intelligent questions.